Take control of submission chaos and automate the process to increase your submission-to-quote ratio.

Smart Submission will transform the way your business views submissions.

We recognise that organising submission data is critical to the success of your underwriting process.

What once was a messy and time-consuming process will feel effortless, with automated submission data and improved underwriting performance.

From the insertion of customer-defined rules to automatically identifying the appropriate SLA – Smart Submission provides the insurance expertise and workflows to support this.

Faster submissions

Generative AI to extract data, auto-populate submissions, and highlight any missing information.

Enhanced submission routing

Configurable workflows, duplication and knock-out rules, and the ability to manage submission priorities.

Visibility of your submissions

Central visibility of submission status to be able to track at individual and team levels and identify bottlenecks.

Enriched submission data

Submissions are enriched with third-party data APIs to improve the quality of data on your submissions.

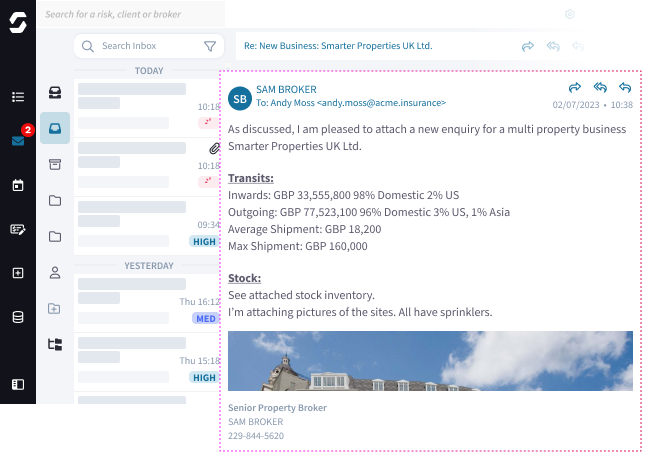

Smart Submission Inbox

As soon as a new submission is received, generative AI will review the content within the email and attached documents to intelligently assist the creation of your submission.

This means that your submission will be worked on the second it arrives.

Smart Submission lifts data directly from the submission, to preserve data quality and save manual effort by avoiding rekeying.

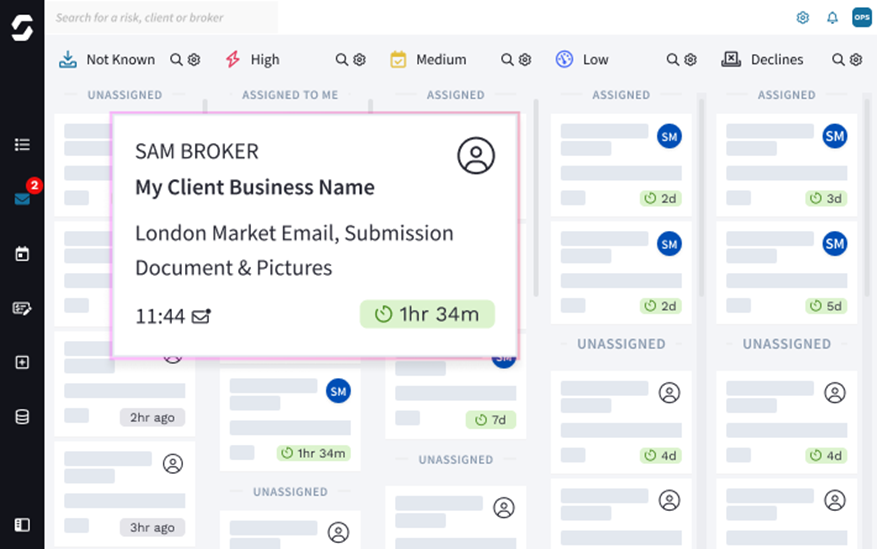

Submission Triage

Users can toggle easily between the inbox and triage board to review submissions where required.

Submissions are enriched and marked as either high, medium, or low priority – these are automated rules set by you that help pre-determine the priority of the submission.

Depending on how confident you are with the data you are receiving, this can also help you automate declines.

Your submission triage can be set up for teams to self-serve, or for managers to bulk assign incoming submissions.

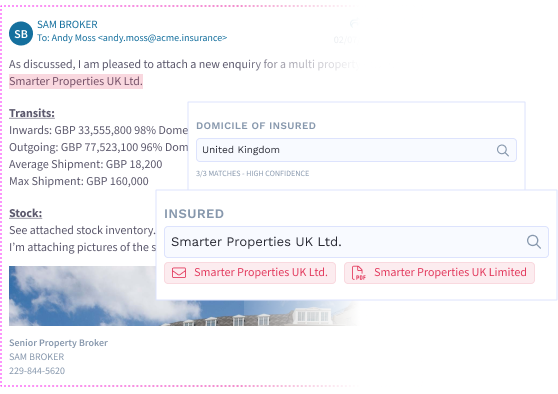

Data Enrichment

Smart Submission will extract and auto-populate or suggest data that has been extracted during the pre-processing.

We use data services to work behind the scenes to enrich your submission data.

These data services include a wide range of integrations that can be aligned with your requirements.

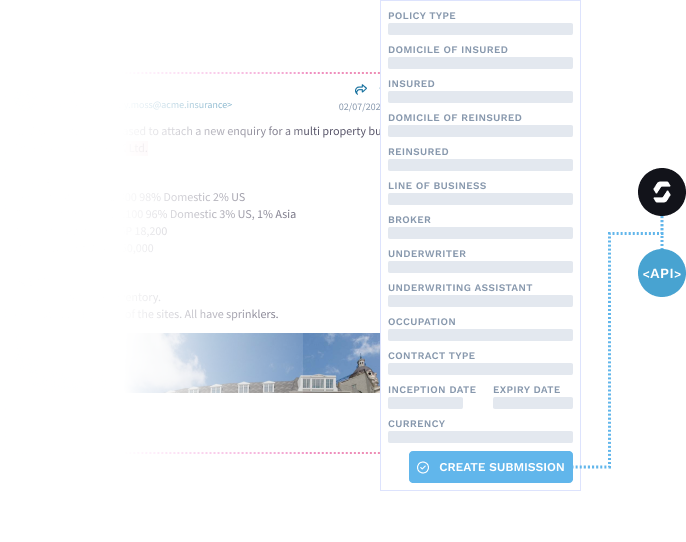

Risk Creation

Once you have the data required to create the risk, submissions can be created directly to your Underwriting Workbench or your platform of choice.

Want to learn more?

Book a demo

Benefits

Unified inbox

Give your teams a real-time view of the Smart Submission shared inbox.

Make sense of unstructured data.

Data extraction to create submissions with unstructured data.

Automated Submissions

Submissions can be created automatically with little to no rekeying.

Improved performance

Automated submissions can increase your submission-to-quote ratio.

Triage dashboard

Provide your teams with a view to efficiently triage and manage submissions.

Real-time insights

Advanced rules can be created to determine appetite and other business preferences.

Manage your SLAs

Set your SLAs and logic to manage submission timing and prioritisation.

Connect to your Workbench

Submissions can be sent to your Underwriting Workbench or platform of your choice.

Data Ingestion Technologies

We can easily align to your business requirements and lines of business.

Ready to automate and organise your submissions?

Schedule an appointment today and learn how you can manage inbox chaos and speed-up submissions with automated extraction and processing.

Learn more about how teams are using generative AI to manage unstructured data and automate their submission process.

Smart Submission can automate and organise your submissions to increase your submission-to quote ratio.

Smart Submission is available as a stand-alone product or as part of Send Underwriting Workbench. Download Now