Composable insurance software solutions ... the future of the modern enterprise. But what exactly is it and why should insurers care?

As CTO you’re under enormous pressure to keep operations running smoothly and to provide business transformation through technology. But it’s hard to innovate when you are landlocked by legacy systems that can’t easily flex or scale. Data is often siloed and inaccessible. Changing fragmented systems is slow, expensive, and you can’t pivot fast enough.

For modern insurers that require agility, monolithic applications no longer meet the needs of the continuously evolving business. But fortunately, there’s a better way.

The answer to this seemingly impossible challenge is composable technology. It provides all the building blocks you need to become more flexible. It’s a fluid, pluggable, scalable platform that means you’re no longer locked in to rigid systems.

A composable insurance management software assumes a modular approach. So, you can pick and choose the interchangeable components you need to create a competitive advantage. It’s based around rapid and flexible assembly of independent components, allowing you to combine, and recombine solutions whenever you need to. This gives you the resilience to cope with a dynamic market, and the flexibility to make the change as often as you need to.

Insurers need architectures better equipped for change. Today, agility isn’t a differentiator, it’s a necessity.

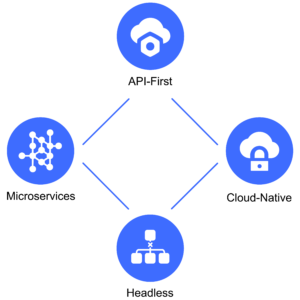

Composable technology is typically built around 4 factors, known as MACH (Microservices, API-first, Cloud-native, Headless):

- Microservices – this collection of small services replaces the traditional, monolithic application. Each service is created to perform a specific task and is independently deployable.

- API-first – for microservices to communicate they rely on API technology. But APIs shouldn’t be an afterthought. With an API-first approach, we think holistically about how the technical solution needs to work and develop open APIs that are consistent and reusable.

- Cloud-native – this leverages software-as-a-service (SaaS) that is developed, designed, and deployed as cloud-native applications. Beyond storage and hosting, it enables elastic scaling of highly available resources.

- Headless – with a headless approach the front-end presentation is decoupled from back-end logic. This means enterprises are framework agnostic with the freedom to design their own user interfaces.

At Send we base our composable insurance technology solutions on 3 core principles:

Built for change

We assume disruption is normal and encouraged, and insurers need architectures better equipped for change. Our SaaS insurance platform enables you to be on the front foot, to try out new concepts, and to make rapid decisions on the go. This means you can:

- Rapidly spin up new proof of concepts with minimum risk.

- Safely make changes knowing you have enterprise-grade security.

- Easily accommodate strategic business initiatives and future market changes.

Built for speed

Our microservice architecture enables the rapid, frequent, and reliable delivery of complex applications. By using an agile Continuous Integration and Continuous Delivery (CI/CD) approach we can build, test, and release new capabilities in days. With smaller code changesets this means:

- Faster software builds and quicker results, delivered on time.

- End-user involvement and real-time feedback leading to improved product quality.

- Reduced cost and effort with less-time consuming releases and upgrades.

Built for growth

We assume businesses need to flex up and down. With ‘always-on’ cloud architecture you can effortlessly ramp up as your business changes. Integration is simplified with API’s enabling highly dynamic workflows. With our SaaS insurance platform this means you can:

- Evolve your technology stack with frictionless connectivity to other applications.

- Reduce your technology spend and wastage, and only pay for what you use.

- Scale without limits as your business grows.