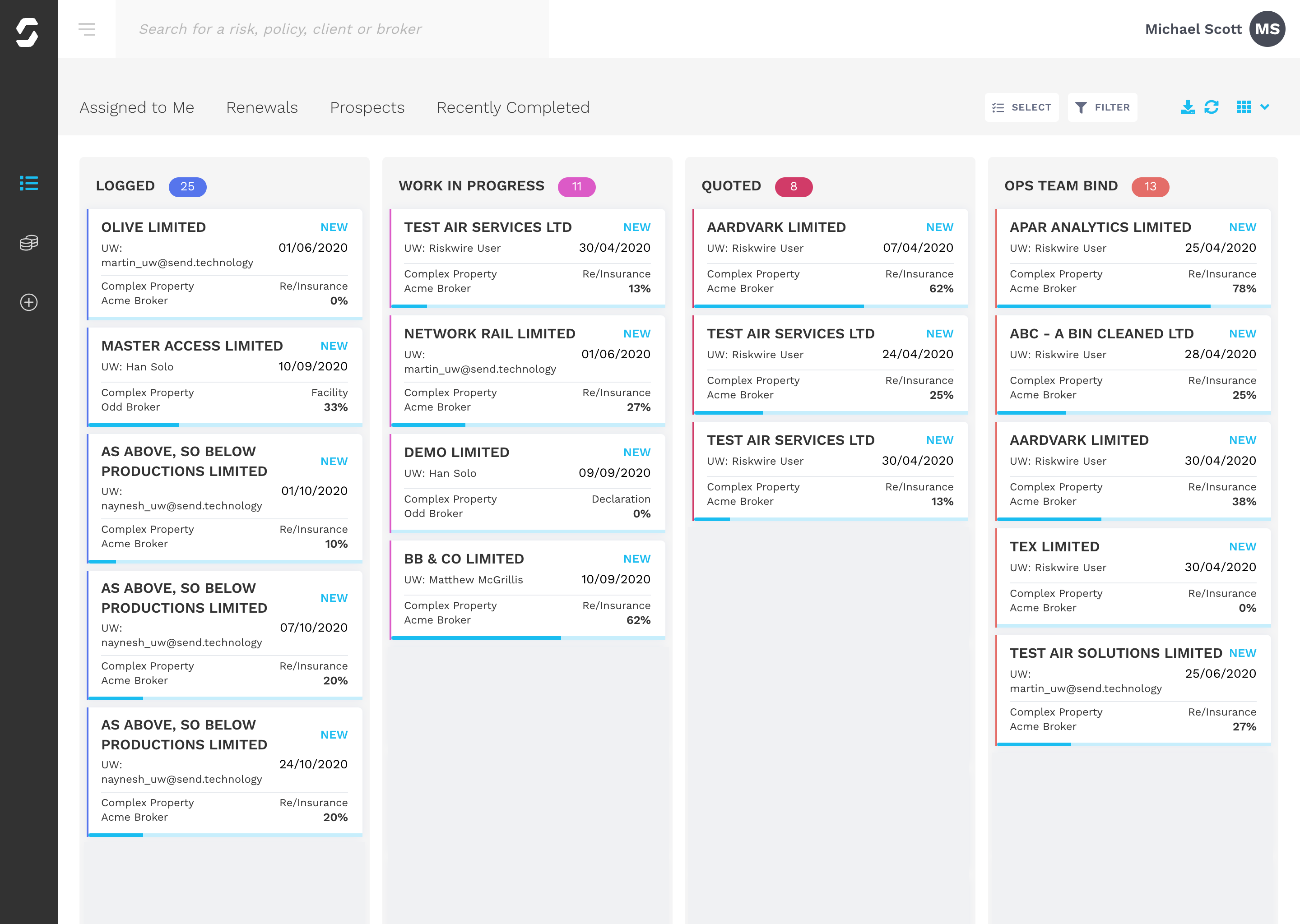

A single platform for managing new business, renewals and endorsements #loveunderwriting

To make rapid, accurate decisions underwriters need information at their fingertips, in real-time. Our cloud-based, web service-enabled, AI-assisted workbench is enriched with business intelligence. Better reporting, seamless workflows and a single customer view not only enable a better handle on productivity but enable you to lead with commercial confidence.

Understand risks

Seamlessly ingest complex third-party data and get a clear understanding of risk.

Automate your tasks

Automate admin-intensive tasks and eliminate rekeying.

Standardise Journeys

Standardise underwriting journeys and processes for dynamic modelling.

Track Work

View and track work through the entire lifecycle.

Regain Control

Regain control and focus on core work that drives growth.

Scale on-demand

Remove the barrier to innovation and be ready for change with an agile platform.

Why choose Send?

Since 2017 we’ve been transforming the world of commercial insurance. Our SaaS platform enables you to fundamentally change and improve how you operate:

UK born with global reach

Headquartered in London

Our market

Global commercial specialty market

Who we help

Insurers & MGAs

Our customers

From start-ups to enterprises

Technology and delivery partners

2017

Start-up

10

Customers

Deployments

in multiple countries

80+

Staff

£3.5bn

GWP processed via Send platform

40+

LOB templates

What industry advisors are saying

80% of insurers believe they need to innovate faster than ever to keep a competitive advantage.

Source: Accenture

40% of underwriters time is spent on admin tasks.

Source: McKinsey & Co

What our customers are saying

Reduction in processing time

More time to focus on core work

Decision-making in record time

Discover how the data explosion is changing the world of commercial underwriting

The Rise of the Exponential Underwriter

For many underwriters, the data explosion provides both a challenge and an opportunity. Solving complex risks problems is a highly sophisticated process that relies not only on deep and extensive first-hand experience but also on mining and interrogating multiple, disparate data sources.

In our latest free guide, discover

- What it means to be an exponential underwriter

- The role of AI in creating a virtuous circle of data

- How you can transform your company into an insight-driven organisation

A Beginner’s Guide to Underwriting Workbench

To become insight-driven, a modern CUO needs to be both a technology trailblazer, and a data master. But how can you make time for differentiator projects with rigid systems, data sprawl and manual workloads? Cue the Underwriting Workbench.

In our latest free guide, discover

- What an underwriting workbench is and why you need it

- How a workbench solves critical business problems

- Typical features of a workbench and how it fits within your ecosystem