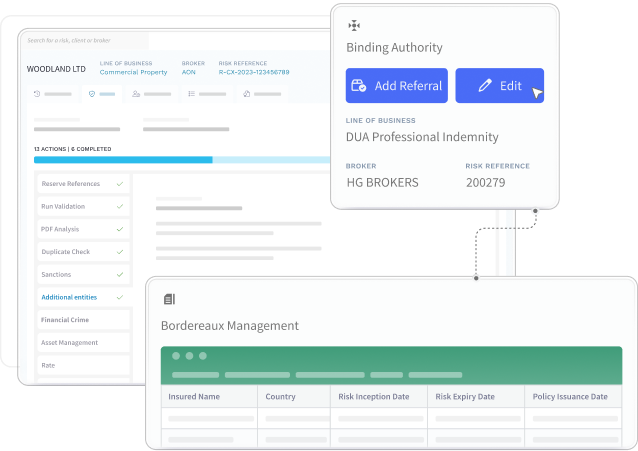

A single platform for all work

Regain control and focus on core work that drives growth with new business, renewals and endorsement data all together in a single platform.

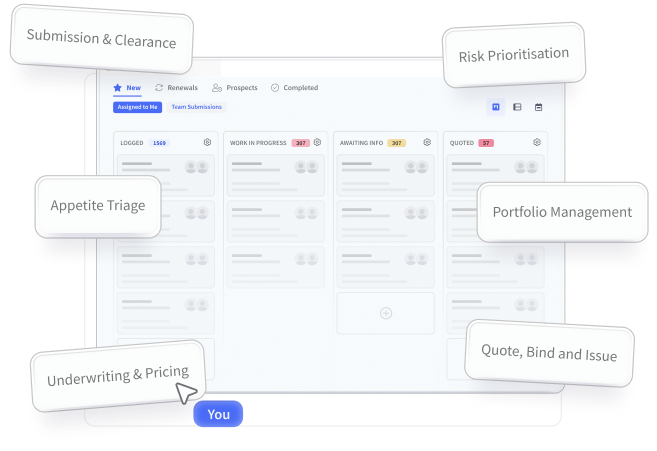

A workbench that accelerates business growth

Remove the barrier to growth with flexible and scalable solutions through our API-first platform.

An Underwriting Workbench that can help MGAs grow and scale as required.

Solutions tailored for MGAs

An underwriting workbench that provides MGAs with the tools to be more competitive in the market.

Accelerate your underwriting capabilities whether starting fresh or looking to connect with existing systems.

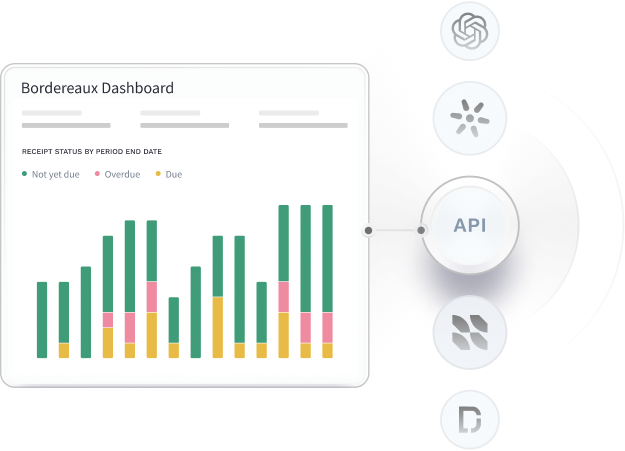

Built for growth

Our microservice architecture streamlines the delivery and launch of new business lines.

MGAs can easily scale and integrate new AI technology and APIs as part of their underwriting strategy.

Underwriting Maturity Framework

Moving from a process-driven to a data-driven operating model

0: Manual Underwriting

Traditional manual, off-system underwriting with information stored within documents and isolated excel files. Work is allocated through email between teams.

1: Digital Underwriting

Enable existing underwriting flow with a structured workflow engine and document/ data storage where teams can collaborate.

2: Connected Underwriting

Optimise the Underwriting flow by leveraging technology to accelerate and automate key steps, data transfers and replace manual steps across the submission-to-bind journey.

3: Augmented Underwriting

Harness the power of the business and operational data captured through digital underwriting to provide targeted insights to underwriters on portfolio position, market and risk characteristics.

4: Smart Underwriting

Enable the system to make automatic, algorithmic underwriting decisions in certain scenarios and provide recommendations to underwriters in others.

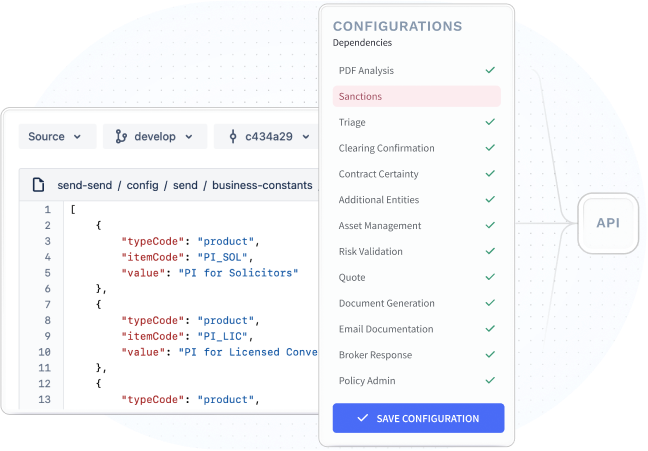

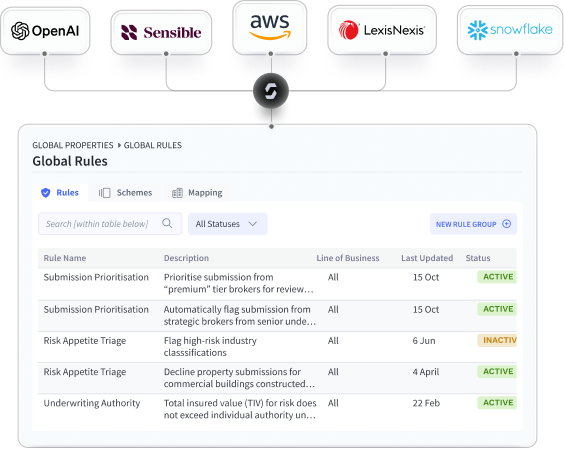

Easily integrate your existing tech and systems

Send is an API first company and is able to integrate with most third-party apps and existing PAS or legacy platforms.

Capture data once and then exchange it through your underwriting ecosystem using our architecture.

Learn moreAccelerated product delivery and development

Out-of-the-box functionality for 30+ lines of business.

Hit the ground running with key capabilities, from submission intake to document generation and decision support.

All with flexible configuration and self-serve tools to adapt to your business processes.

To make rapid, accurate decisions MGAs need information at their fingertips, in real-time.Our cloud-based, AI-assisted workbench is enable a better handle on productivity but enables MGAs to lead with productivity and commercial confidence.