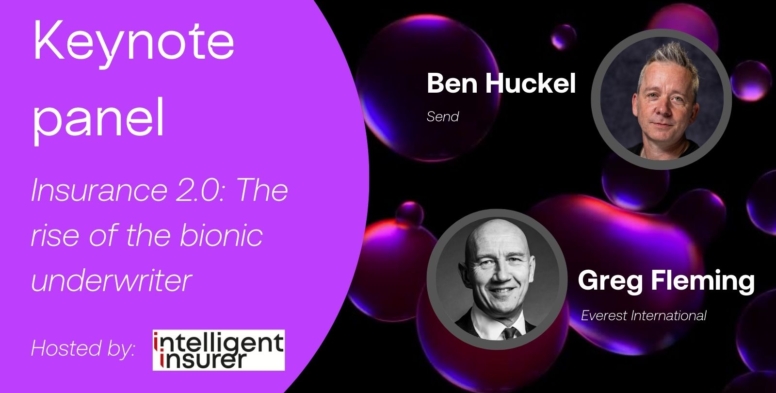

‘We can’t stay the same, we need bionic capabilities’ – Greg Fleming, CIO of Everest International kicked off Send’s keynote panel at the Intelligent Insurer Commercial Lines Innovation Europe conference with a rallying cry to underwriters to harness the benefits of bionic underwriting to keep pace with a changing world.

Greg joined Send’s co-founder and CEO Ben Huckel for a fireside chat focused on the technology and tools available to augment underwriting and help underwriters to do more of what they love.

There was a ripple through the audience when moderator David Clamp introduced the topic of bionic underwriting, so before he could dig into the details of how technology could accelerate the rise of the bionic underwriter, Ben offered a succinct overview of what the concept meant:

“To go bionic means accelerating the parts that make the most difference, honing in on the areas that deliver the best benefit and augmenting them.”

It’s a simple concept, but one many companies are struggling with. There’s a healthy amount of cynicism within the industry, and rightly so. Change programmes have come and gone, new systems have been adopted unsuccessfully, and underwriters quickly return to the tried and tested ways they’ve employed for years.

But as Greg emphasised, the risk landscape is changing all the time, “risks are changing and the losses are getting larger and larger, systems need to keep changing to match that”. The industry simply cannot afford to keep taking the same approaches it always has. To remain competitive, businesses have to modernise their estate, they need simple, lightweight systems that can quickly adapt and change at the same pace as the market they serve.

This adaptability is a key point. Many in the market are working on large, well-established systems, but as Greg pointed out, ‘the larger the system, the more brittle it is and inflexible to change’. Underwriters can become land-locked in a system, which is a dangerous place to be if they want to remain competitive.

Instead, underwriters need platform capability that will help them to modernise, quickly launch new products, compete with new players as well as established leaders and crucially, adapt to market change. Ben reminded the audience that “change is a constant”, and the sooner we can accept and embrace this, the sooner we can start honing in on those areas of the role that need to evolve to deliver the best benefits to the business.

Built for change

It was here Ben turned to the concept of composable platforms, likening them to a recipe, where we can swap different ingredients, add and enhance elements to find the perfect recipe for the success of each unique business.

In practice this means developing individual components that can be selected and added to augment and accelerate existing systems. Greg explained that his approach at Everest International is to hollow out the system “piece by piece”, there’s no longer any need for “multi-year, multi-billion pound projects”, these have been tried before and suck up time, cost and sap underwriters’ confidence. His philosophy is to make change in smaller bites, deliver, then move on, focusing only on the aspects you need rather than taking a ‘rip and replace’ approach.

But change must happen quickly. Underwriters’ expectations for their systems and processes are changing rapidly. Rather than the out-dated view of underwriters being “cast in stone”, Greg commented that they get it; they want change, and they want it faster. And it’s the job of companies like Send to work with underwriters to deliver the tools and systems they need.

Tools like Send’s Underwriting Workbench and Smart Submission are functionally powerful, but Ben emphasised how important it is to listen carefully to the teams using these tools on a daily basis. Anyone who tries to build a solution for underwriters has to be able to understand their processes, their daily challenges, the workarounds they use to get their job done. Only by listening and building a solution in close collaboration with these teams can we develop tools that underwriters actually want to use.

Human in the loop

For those not familiar with the concept of an underwriting workbench, Ben outlined some of the challenges underwriters routinely face, and how a workbench can solve these:

- Double-keying, even triple-keying into different systems

- Tracking work on spreadsheets, email, whiteboards or network drives

- Slow, manual workflows

- Different lines of business requiring different systems and processes with data not feeding into each other or being able to easily report against.

He explained that a workbench is about calming that submission chaos, taking underwriters from submission to bind in one single platform and promoting automation where possible. Really accelerating the parts of the process that can be automated to allow underwriters to focus on simply, underwriting.

Automation can be an unnerving concept to some, but Greg and Ben were clear that the concept isn’t about replacing underwriters with machines. Where Ben believes that these tools keep the “human in the loop, allowing underwriters to focus on the art of their trade”, Greg concludes that; “people are the best tools you’ve got. The trick is to give them the tech to let the machines do the dull stuff, the mechanical stuff, leaving people to exercise their grey matter to make the best decisions and help their businesses grow.”

Click here to find out more about Send’s Underwriting Workbench.