Helping underwriters move from a process-driven model to a data-driven model.

Commercial underwriting is evolving, but whereas the strategic imperative of yesterday was to standardize processes and remove frictional costs from the value chain, the focus has moved to data maturity. There is a new emphasis on leveraging data to improve risk selection, pricing, customer-centricity and AI enablement. The bar is being raised and carriers must shift from being process-driven to data-driven, from operational efficiency to underwriting excellence, to remain competitive and profitable.

The data challenge and opportunity

Underwriters have access to more data than ever before. The prevalence of rich, abundant data can help them move from pricing based on historic risks to predicting and modeling future risks. However, they must reach a point of maturity to enable them to reap the benefits of this data.

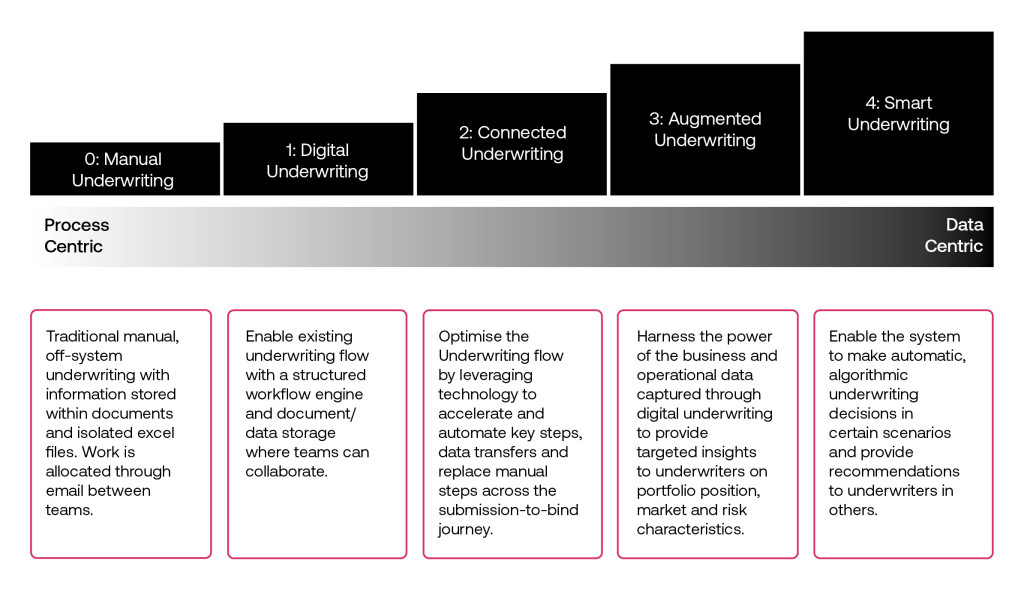

It’s no longer enough to find smart ways of ingesting, storing and managing data. Underwriters must embrace a data-centric operating model to leverage internal and external data sources and services to drive automation, augmented insights, and decision-making. In other words, they must move from manual underwriting to smart underwriting.

5 stages of evolution

We have identified five stages in the evolution from manual to smart underwriting:

Insurance carriers will find themselves at different points along this journey depending on factors like historical investment, systems and culture. Though the joint goal of the market may be to reach smart underwriting ‘nirvana’, we recognise that not all carriers are in a position to go from 0-4 in a short space of time.

Any underwriters sitting at the beginning of this spectrum may be overwhelmed by the changes needed across their data and operations functions to reach full maturity. However, by breaking evolution down into stages, we can demonstrate that incremental, yet meaningful changes can have a powerful impact on the business’s journey from process to data.

Pause and reflect

We’ve created our Underwriting Maturity Framework to help carriers identify characteristics of each stage, and spot opportunities to use AI to augment and enhance core tasks. By mapping a carrier’s current state to the model, they can paint a powerful picture of evolution over 6, 12, or even 18 months and understand the roadmap to achieve their objectives.

Using this tool to identify and visualise the building blocks of change will be important for securing buy-in from all business areas, from underwriters to technology teams, ensuring everyone can see and understand the over-arching objective and their role in this transformation.

Over to you

Do you know where your organisation sits on the maturity spectrum? In our Underwriting Maturity Framework, we’ve set out a number of key questions to help you plot your ‘as is’ state and get you thinking about where you want to go.

- Download our free Underwriting Maturity Framework for Commercial and Specialty Insurers here.

- To talk to one of our team about your journey from process-driven to data-driven, contact us here.