Snapshot: how does Send stack up against independent review?

“With a selection of pre-built templates and workflows for 30+ lines of business, these can solve most of the common issues and bottlenecks across the underwriting process.” Altus Consulting

We know our award-winning Underwriting Workbench has the power to transform commercial underwriting, making processes quicker, and more efficient for the underwriters who use it.

But how does our Workbench stack up when reviewed and assessed independently?

Altus Consulting produces a series of InsurTech Snapshots in collaboration with innovators across the insurance market.

“Through a single platform, a consistent underwriting process is adopted from submission to bind and beyond. Acting as a ‘one-stop desktop’, underwriters benefit from a platform where resources, data and work align.” – Altus Consulting

These Snapshots review the core capabilities of products like the Send Underwriting Workbench and map them against more than 1,300 capabilities using the Altus Insurance Capability Framework.

Click here to see Altus Consulting’s snapshot of the Send Underwriting Workbench in full: Send | Papers | Altus

Here’s an extract from the report:

ALTUS REVIEW

Historically, the management of the underwriting process across re/insurers and MGAs has lacked uniformity. For example, the way in which policy submissions are received from Brokers is in varying formats. Coupled with the fact, there are inconsistencies in how terms are provided back out to the market by underwriting teams. This continuation of poor data structures via unwieldy spreadsheets continues to generate unnecessary complexity, resulting in more time spent by underwriters navigating and distilling the information, rather than focusing on what matters—that is underwriting the risk. Send has developed a consistent workflow approach, introducing efficiency and AI-powered data learning to the underwriting process.

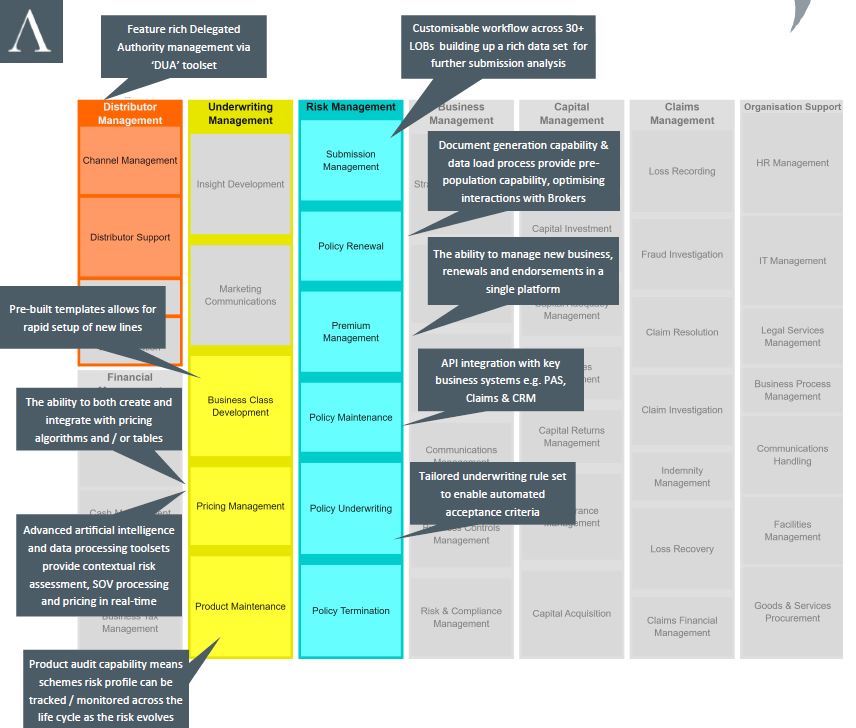

Through a single platform, a consistent underwriting process is adopted from submission to bind and beyond. Acting as a ‘one-stop desktop’, underwriters benefit from a platform where resources, data and work align. With a selection of pre-built templates and workflows for 30+ lines of business, these can solve most of the common issues and bottlenecks across the underwriting process. The platform enhances the underwriting process through ‘conversational’ workflow, better supporting the non-linear nature of conversation between insurance parties. The technology is composable, enabling microservice architecture and solutions designed by selective business components.

Integration is also key to the platform with an API-first approach via Send Connect (including integration with legacy), the platform has a collect data once approach. This is further supported with pre-build connectors to key systems such as policy admin systems and pricing engines.

Altus Consulting independently reviews Send’s Underwriting Workbench and maps the capabilities using the Altus Insurance Capability Framework.