Integrated Coverholder, binder and bordereaux management

Whether you are looking to scale or manage your existing delegated business, our platform helps insurers manage the increased volume of data that comes with Delegated Underwriting Authority.

We’ve developed integrated workflows and capabilities built-in to effectively manage your delegated business processes as part of our Delegated Underwriting Authority solution.

A single platform for open market and delegated business that provides a standardised view of risk exposure in real-time.

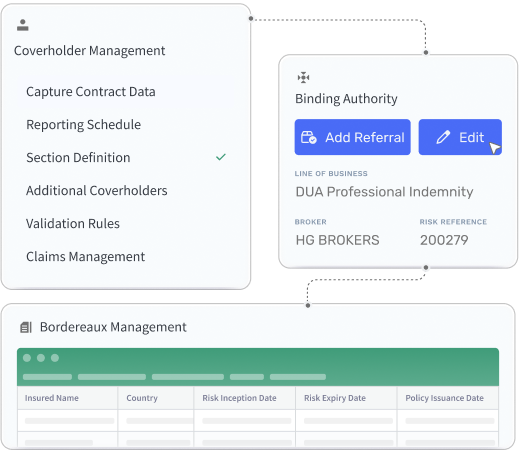

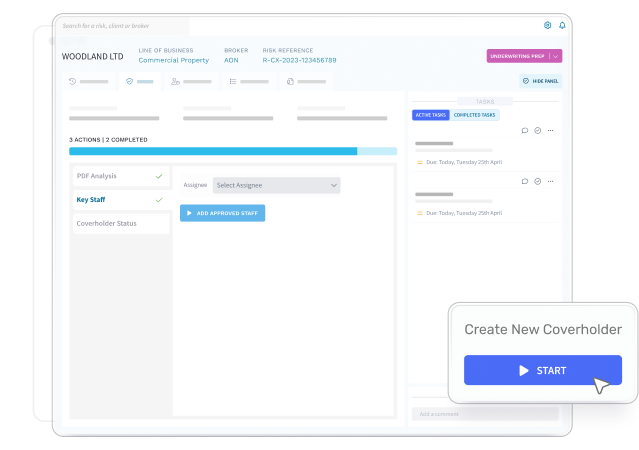

Improve Coverholder management

Workflows simplify the process of creating new and managing existing Coverholders. Data services ensure you are using a known entity when creating a Coverholder and referrals to manage Coverholder approvals.

Manage your binding authority

Use an integrated review and approval process for your binding authority contracts. Capture essential contract data to validate against bordereaux.

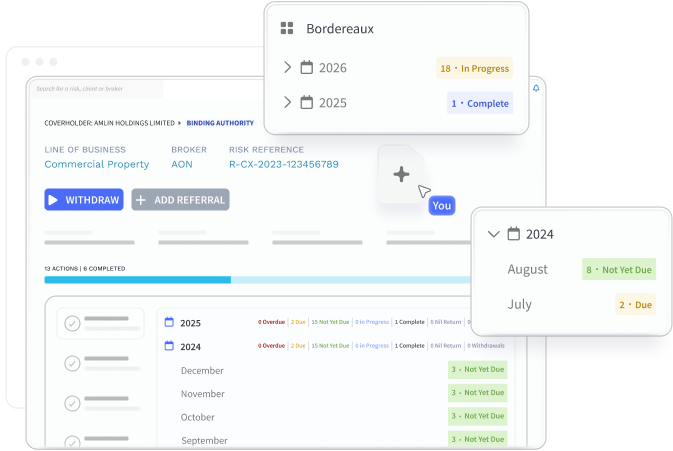

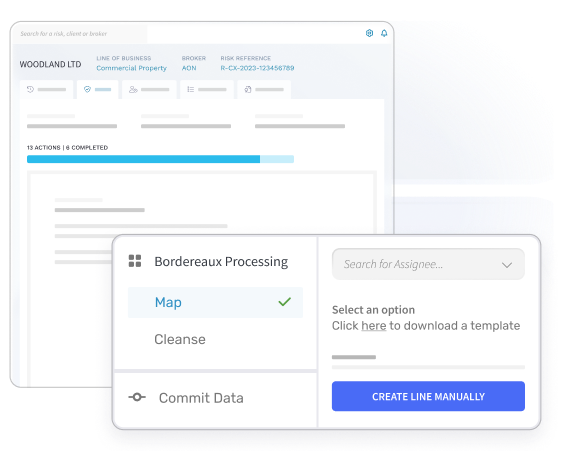

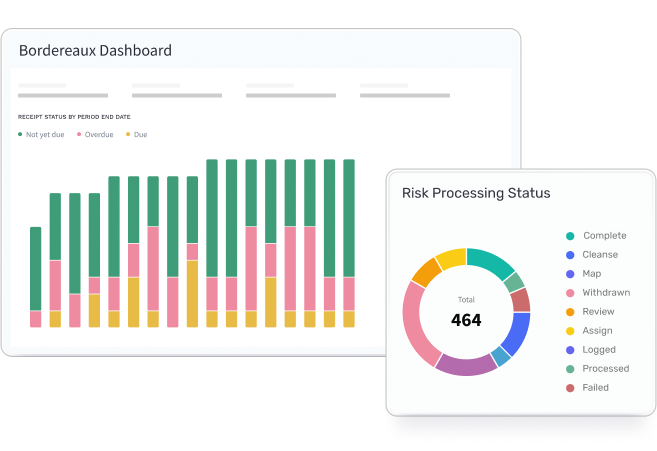

Streamline bordereaux management

Process and map unstructured bordereaux data from Coverholders, while our platform captures key terms within the workflow to validate bordereaux data as it is ingested.

Unlock powerful insights

Easily track bordereaux, generate consolidated data outputs, and review validations through comprehensive reporting capabilities.

We combine the power our of market leading Underwriting Workbench with robust Coverholder, binding authority and bordereaux management capabilities within a single platform.

Features

Built on a leading Underwriting Workbench with proven workflows for Coverholder, binder and bordereaux and management.

Standardise and map data from unstructured bordereaux data from multiple formats, including API ingestion.

Workflows can be set up to automatically check for key terms in a binder or contract to validate data as it is ingested.

Workbench remembers previous mappings, and will suggest mappings for new bordereaux with intelligent ingestion.

Data led and insight driven dashboards provide insurers with a real time view of premium, risk and claims data.

We capture both supplied and mapped data which can be reviewed as part of an audit process where required for full traceability.